Narrative violations

Don't trust your i̶n̶t̶u̶i̶t̶i̶o̶n̶/Don't trust the d̶a̶t̶a̶

Human beings are story-telling monkeys. This ability likely offered advantages from an evolutionary perspective. Our ancestors formed narratives in the Savannah, were able to form tribes and colonize the Earth’s entire landmass. Today, our ability to construct meaning from data allows us to determine the direction of causality. We double down on things that work and avoid those that don’t. But this tendency to constantly weave storylines comes with a dark side. Today, I will show you that side.

Let’s take one popular idea from the current business zeitgeist: asset ownership is declining as businesses like Uber and Airbnb take over the world. One corollary that I have seen many times is that car ownership is declining. And it will only get worse as the pesky millennials get older and have kids. Let’s look at some of the business press this idea has gotten over the last couple of years. Here are some headlines from Bloomberg, New York Times and WSJ.

New York Times:

WSJ:

Bloomberg:

Now, let me show you some data from Spain to seal the deal on this theory:

If you’re anything like me, your mind is already racing to a 100 rationales for as to why the above might have happened. Buzzwords like ride-hailing, car-sharing and urbanization are probably running through your head. If you’re a good consultant, you are probably already plotting your next move. This could be a huge opportunity. It will totally disrupt multiple industries. Should we invest in this trend somehow? Could I launch my own ride-hailing company? Perhaps an app where people share their cars and save the planet? Look, this claptrap is probably happening in different corners of the world right now. This is the bread and butter of consultants, bankers and a permanent intellectual class of white-collar folks. They make their consulting and advisory fees by betting on disruption. We may even call them ‘disruption merchants’. See, their incentive lies in convincing everyone that trend A or trend B has happened or is about to happen. That’s what they get paid the big bucks for really.

Now, before I slag consultants any further, let me show you another less sombre looking graph from Spain:

So, there was decline but that was really after the 2010 European financial crises. In the recovery period, car registrations continue to trend upwards and grew last year too. WTF? That doesn’t add up. Look - maybe, Spain is just an anomaly. I’ve never trusted Spaniards much in any case. Let’s go to urban United States. The US always has good data and is at the forefront of any technology revolution. And come on, all my friends keep telling me that cars are dying in cities like New York, San Francisco and Boston. Mary Meeker even did a fancy graph on this in her tech trends report showing how car ownership was actually more expensive than taking an UberX. This graph from 2 years ago:

Zipcar did a study back in 2012 showing how Millennials hated the idea of owning a car. And a bunch of follow-up studies showing how driving a Zipcar was so much cheaper than owning a car. You might have even seen a graph like this:

Or this:

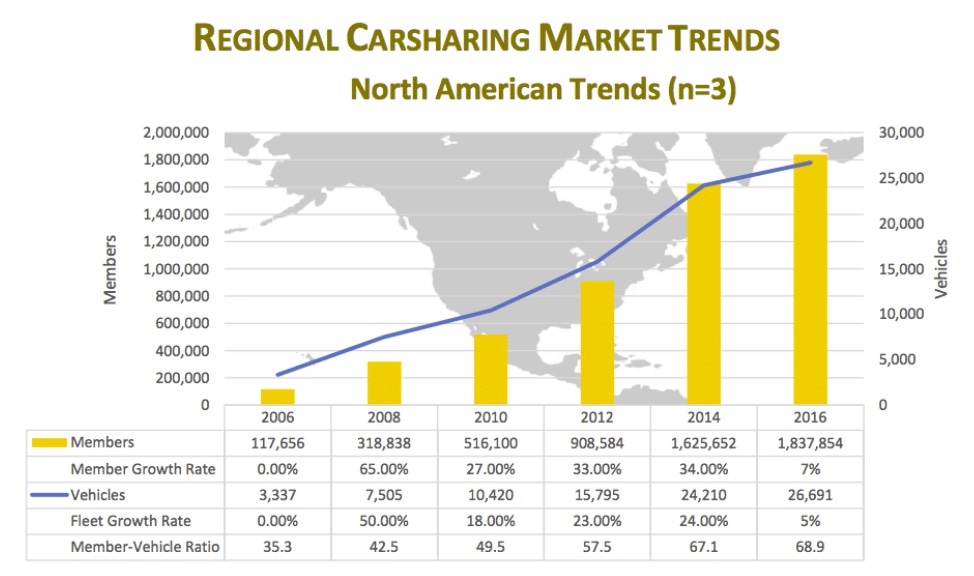

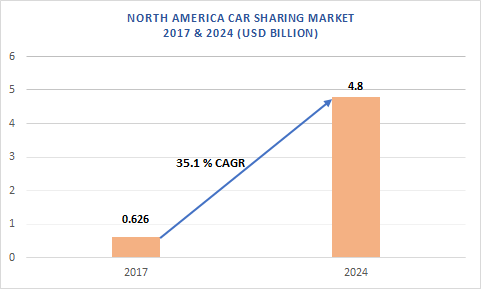

I mean car-sharing is the future after all.

What about ride-hailing? You know everyone takes an Uber now. My granny took one last week. (she didn’t) And I mean we know this whole market is just about to explode as more and more people switch to taking an Uber. Just consider this graph:

So the US ride-hailing market will more than double in size within 5 years. That means CAGR > 30% for 5+ years. Exciting times for the ‘disruption merchants’.

Time for a reality check. Let’s pause and reflect. What about some more recent data?

Here is the actual data for Uber, the runaway market-leader for ride-hailing. Here is how their growth rate has tracked over the first quarter of this year:

So a measly 4.5% growth in the core ride-hailing segment. No wonder the company is trying to branch out into UberEats, grocery and credit cards to keep the growth narrative alive.

Let’s consider the evidence on decline of cars in big cities. Here’s an excerpt from a recent piece in Wired magazine:

But here’s the funny thing: Personal car ownership in the US has actually increased in the past 10 years, even in the frenzied urban places where Uber and car-share have become verbs. According to research from former New York City transportation official Bruce Schaller, the number of vehicles has grown faster than the population in some of the cities where ride-hail is most popular: Boston, Los Angeles, New York, Philadelphia, and Chicago.

And here’s the actual data from the study that Wired references:

There’s clearly a big narrative violation going on here. To the rational brain, this is just plain annoying and painful. All the stories that we wonderfully construct in our brains fall apart when confronted with such data. You might live in denial (‘they have not measured car ownership correctly’). You might offer rationales to keep the narrative alive (maybe this is a blip as VC funding dries up as we approach a recession). Or you might construct completely new theories altogether. And like most new theories, your theory will likely be wrong.

Look, I’m that person who constructed such theories for a living. I still do to a lesser extent. There is no shame in that. The story of human progress stands on the shoulders of personalities like Steve Jobs and Elon Musk weaving such compelling narratives. But we must also always keep an open mind and try to separate signal from noise. Many things we all believe will likely turn out to be wrong. That’s okay, our lives don’t depend on ride-hailing being the future or autonomous cars arriving by 2025. But let’s not get married to our ideas. Let’s not bet our reputations on any theory - be it political, social or economic.

Naval Ravikant once said in a podcast that he is skeptical of ‘climate scientists’ by default because of their titles. He’s actually a believer in climate change and has spoken on the need for humanity to address it as an urgent issue. His point is that carrying the moniker ‘climate scientist’ prevents both sides from a fair and balanced discussion. A similar dynamic often emerges in large companies. You end up having ‘Innovation’ teams, you have ‘Startup’ teams, you have ‘Electric Vehicle’ teams and so on. Once an employee becomes part of such an ingroup, he or she must preach the gospel. And that is often the reason that people in such teams continue to peddle the same ideas, even when confronted with opposing data.

I write all this after having recently read news about Fair, the much hailed car-subscription service. The company is laying off 40% of its workforce and the CEO has resigned. This is a company that was supposedly valued at $1.2B just last year when SoftBank invested $385M in it (Who else but SoftBank?). I often think of this SoftBank deck that I saw a few years ago. I highly encouraged everyone to skim through it.

There are two ways to think about SoftBank’s vision (pun intended):

What a bold and beautiful vision for the future

What an idiotic set of slides pulled together by a bunch of teenagers

I will end with a quote from F. Scott Fitzgerald:

“The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function”