Mind the gap

How under-penetration remains the biggest m̶i̶s̶s̶ opportunity in the insurance world

The Economist did a great piece recently on the mounting risks faced by the uninsured in the developing world. (thanks MK for the plug) Here’s one graphic that caught my attention:

While there are a few ways to interpret the graph, there seems to be a persistent chasm between insured and uninsured risk events. This runs somewhat contrary to the popular narrative of human progress and achievement. Consider this - for the vast majority of industries, the last few decades have been one of broadening appeal, access and inclusion. More people today have televisions, smartphones and healthcare than at any other time before in human history. Innovations like mobile money and cryptocurrency have brought millions of unbanked into the financial economy. And yet, the insurance industry hasn’t quite kept up in this regard. Here’s how worldwide insurance penetration has tracked over the last 30 years:

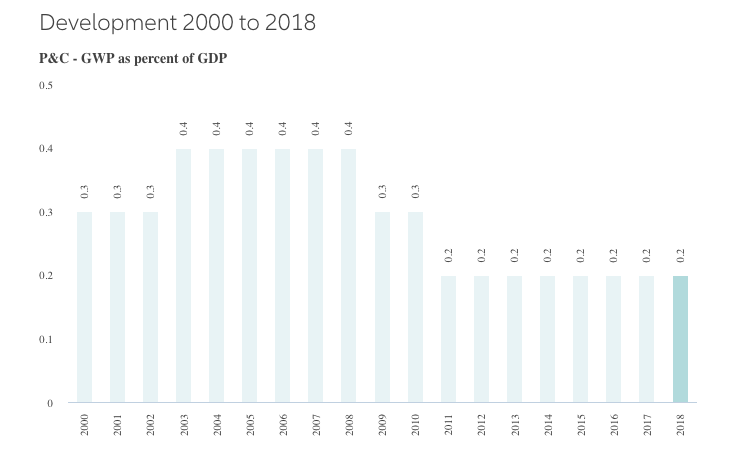

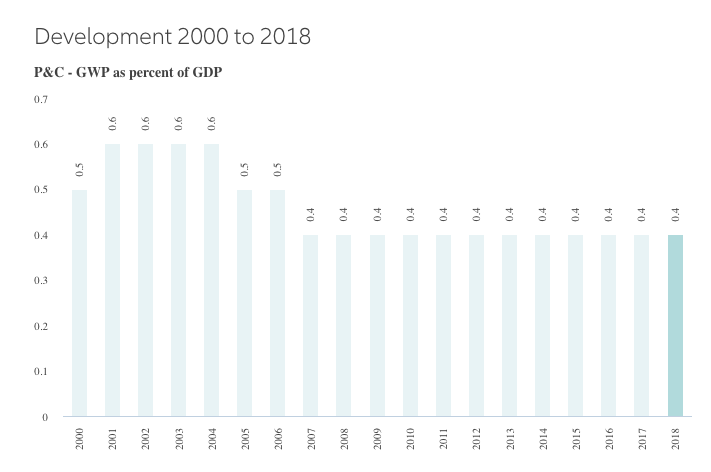

So fairly flat with seemingly some progress on the emerging market front. However, this picture also becomes grim once you exclude China. You can check out the evolution of insurance penetration rates among individual countries using this tool provided by Allianz. Needless to say, it is not the prettiest of pictures. Countries that are at most risk from global climate change and other risk events, seem to have either not moved the needle or have even seen a decline in insurance penetration over the last ~20 years. Let’s use Vietnam, Pakistan and Indonesia as examples to illustrate this point. Here are the penetration graphs for these countries:

Vietnam (96M people)

Pakistan (200M people)

Indonesia (264M people)

Now P&C premiums as a percentage of GDP might not necessarily be the most accurate barometer of insurance penetration. But it gives us a measure of progress (or lack thereof). But the problem is much wider as decades of under-investment has left many of these developing economies with a shriveled insurance industry. Here is a depressing excerpt from a recent Wired piece on Indonesia’s insurance industry:

One might naturally ask that if the problem is so big, why aren’t entrepreneurs jumping on the next flight to Asia. And surely, the scions of Silicon Valley would be happy to back the next wave of startups looking to expand insurance access. Unfortunately, the data here isn’t promising either. Last year, insurtechs raised a record $3B in total. Nothing incredible once you consider the overall sums involved but nothing to smirk at either. However, let’s look more closely at that $3B figure and consider it’s geographic split. While we don’t have figures for 2018, we have the breakdown for the entire 2012-2018 period. That is probably better as a larger sample reduces bias. Here’s how the pie-chart looks:

So, 18% of funding in total went to ‘other’ countries. And these other countries include Israel, Spain, Italy so the actual split going to just emerging Asia and sub-Saharan Africa is <10%. So private markets aren’t doing much here.

But public markets aren’t much different. Big insurers have opened branch offices in a few of these countries but they remain footnotes in their financial statements. I am sure most C-suite could not even tell their market share or # of customers in such small countries as they aren’t core. Go through the earnings call transcript(s) and investor presentations of Berkshire/Allianz/Axa and you will hear tonnes of discussion around KPIs, use of AI and future product plans. You will hear about innovations like instant claims settlement and mobile apps. And yet, that is not where most of the low-hanging fruit lies. Increasing insurance access and appeal is the 800-pound gorilla that few seem to be focused on. In as much as insurance is about protecting the world and its population against risks, that is the only metric that should matter. And yet, both private and public markets continue to largely ignore this. The insurance industry would look pretty much the same if we had fewer fancy mobile apps and pretty UXes. And yet, it would be very different if we got the insurance penetration rate(s) up in Asia and Africa. And that is where public and private markets should start focusing more.

To receive more posts like this, sign up for our daily newsletter!