Lemonade and the Art of Spin

Reading between the lines of the company's latest 'transparency chronicles'

There are not that many interesting direct insurance startups. As such, the few that exist have captured the imagination of the investing public. Much like GAFA, the insurance world has its own Gang of Four when it comes to startups. The four companies that have become synonymous with the term ‘insurtech’ are Lemonade, Root, Metromile and Wefox. Today, I will look at the most well-known among this pack: Lemonade.

Lemonade is definitely an interesting company. There is a lot to like about it. They have a product that consumers truly love. They have a great brand. They are pushing the needle on claims experience. They have got a unique D2C model. All of that in itself should be enough to guarantee success. But if there is one lesson we can take away from the WeWork episode, it is that you can have an a product liked by customers and yet still struggle to survive.

Reading Lemonade’s most recent post around its business performance, I came out less than impressed. I will discuss a few of my concerns here. Let’s start from the top. I want to start by tackling their strategy - here’s what Daniel Schrieber, Lemonade’s CEO, has to say:

Now, there is nothing wrong with the above paragraph per se. After all, this is pretty much the kind of mumbo-jumbo that companies delineate in their annual reports and their websites. But if you dig deeper, you realize that there is actually little substance to what is said and Daniel reveals actually nothing interesting about the company. So my gripe here is that such statements should be parked for the PR piece, not a blogpost titled ‘transparency chronicles’. Consider again these words:

"You see, delighted customers fuel growth, growth spawns predictive data, data powers the machine learning that improves our performance, to the delight of consumers"These remind of a post by Farnam Street on how much of what gets said by companies is actually meaningless jargon. Read this passage below from Enron’s 2000 shareholder report:

Now re-read the strategy line above. You should realize that Lemonade’s ‘strategy’ could literally be copy-pasted into the annual report of any financial services company in the world. And investors won’t be able to tell the difference.

Here’s the reality around what Dan claims: customers don’t actually feel delighted if predictive data leads to their premiums changing. Most customers aren’t overly excited about sharing data unless it comes with hefty discounts. And that strategy in itself has its limits. I’d have been more intrigued if Dan had said that their strategy involves collecting less data on customers to delight them. But to pretend that somehow there is a flywheel effect at play here is completely disingenuous.

Let’s keep reading through the rest of Dan’s post. There now comes a part around growth that really irks me. The strategy stuff is light-hearted semantic jostling. But now we are dealing with numbers. Here is what is claimed:

Now, this is frankly ridiculous. The benchmark that Dan mentions is for ‘cloud’ and/or SaaS companies - not your run-of-the-mill insurance companies with high capital constraints. And to characterize an insurance company’s GWP run-rate somehow as ARR is such an inversion that it would lead to an SEC complaint if an insurance company did it in an official document. So this is really comparing apples to oranges here. Given the fact that Lemonade cedes a significant minority of the premium to re-insurers, you might even call it comparing apples to tofu here. Anyways, let’s keep reading:

Ah, we have it - the proverbial hockey-stick graph. The holy grail of any successful startup’s funding pitch deck. And look, I will be the first one to admit that that is extremely impressive growth. But see, insurance is a rare industry where growth is not something you always laud. If a company suddenly underwrites another million customers at a >100% loss ratio, it has only destroyed economic value. Dan likely understands this point very well.

But the growth graph is likely the ‘SoftBank effect’ at work. The presence of funds like Softbank has driven otherwise-sane startups to pursue growth at all possible costs. Unsurprisingly then, SoftBank was the lead in Lemonade’s $300M Series D.

What is all the excess capital doing? At marketplace startups like Uber, it has lead to a lack of focus due to the cheap availability of private capital alongside costly price wars. But at an insurance company or a bank, there is no magic bullet around benefits of scale. If all you are doing is underwriting crummy customers, growth can quickly prove fatal.

There is also a secondary problem which makes reading the above graphs hard. Lemonade has raised $480M to date. By my rough estimates, the company has written something to the tune of $150-200M GWP over the past three years. Therefore, it is hard to tell whether underwriting $200M GWP is actually even a good number without a) average customer acquisition costs b) associated loss ratio.

A buy-side analyst once quipped in a report, ‘any idiot can write a loan. It is the ability to develop a profitable loan-book over many years that is interesting’ The same applies to insurance. Any company with deep pockets can pay Google and/or Facebook to sell a bunch of policies. It is the ability to sell policies at a low acquisition cost for underpriced risks that makes all the difference.

Anyways, let’s keep reading through the post:

Let’s consider the companies mentioned - Slack, Twillio, Servicenow and Shopify - as relevant benchmarks. They are all SaaS companies. All of them are public now and operate at >10x EV/Sales trading multiples. That’s the beauty of SaaS really. You get 70-80% gross margins, 30-40% operating margins and LTV/CAC > 3.0x.

But let’s revisit what we said earlier. An insurance company is NOT a SaaS company. Lemonade does NOT have annual recurring revenue. It does not have 80% gross margins or even 50% gross margins. It never will unless it pivots into software. It doesn’t have a LTV/CAC ratio of 3.0x. Worst of all, insurance carriers have to hold a bunch of money for regulatory purposes which means a lot of capital on the balance sheet (unlike the asset-light model of SaaS).

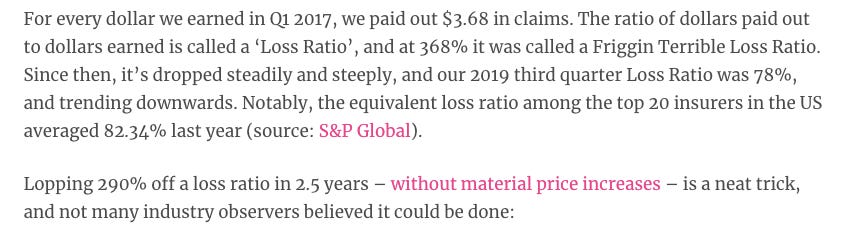

I have a more thoughts on other parts of the blog but I’ll just consider the loss ratio to conclude. Scrolling further towards the bottom, we read this:

Now we are actually looking at some interesting numbers. So yeah, the improvement is heartening to see. But the improvement is from such a high base that too much shouldn’t be read into it just yet. Furthermore, there really isn’t anything such as a Q-3 2019 Loss Ratio. The post was written in November 2019. Loss Ratios take 1-2 years to fully develop so a Q3-2019 number is pretty much meaningless. Moreover, it would be useful to know whether these are based on underwriting years or accident years. (Matteo Carbone has a great post showing the nuances of Loss Ratio and how these numbers can be easily juiced by companies to show investors what they want)

Last but not least, it would have been useful to hear from Dan on rumors that the company had delayed plans for an IPO due to profitability concerns. Transparency chronicles are a great idea and for that alone Lemonade deserves to be lauded. Most startups disclose very little to no information while they are private. So Lemonade doesn’t have to make these posts. But to be truly transparent requires talking about uncomfortable things that you’d rather not be asked about.