Alternative facts

How startups use non-GAAP accounting measures to 'polish' earnings

Numbers don’t lie. Or so it is supposed to be. However, the last decade of marketplace startups has brought the world a whole host of spurious reporting measures. Companies raising money at increasingly aggressive valuations, are getting creative with their KPIs. It all started back in the early 2000s with E-bay and its focus on ‘Gross Merchandise Value’ - the monetary value of goods that exchanged hands on the platform. As the distributor of these goods, E-bay’s share was generally only around 10%. And yet, GMV continued to show up in E-bay pitches and investor presentations.

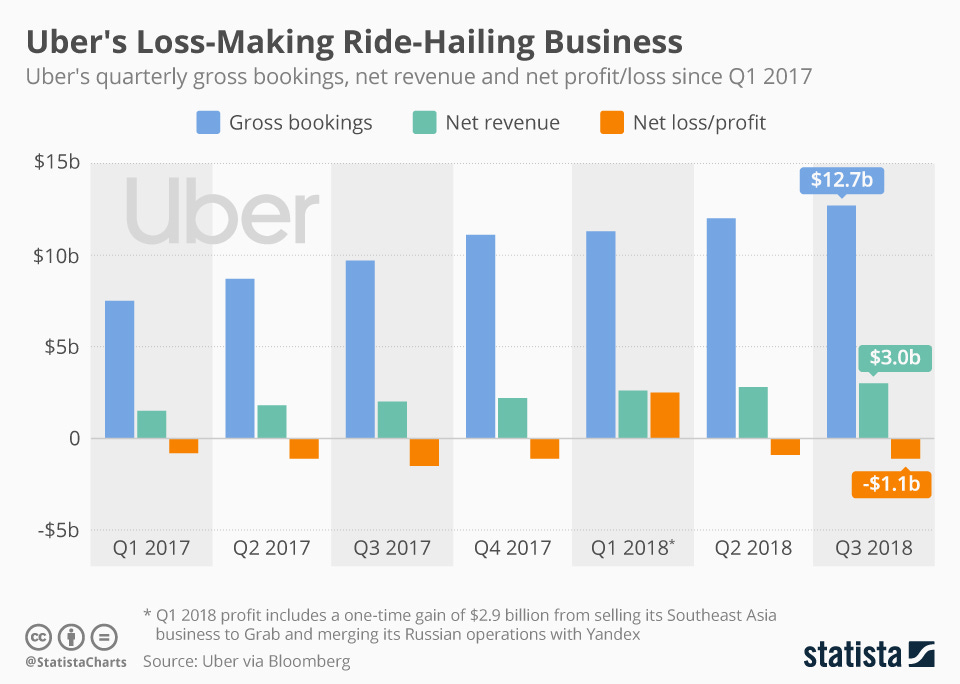

Then came Uber and its ‘Gross Bookings’ figure. Given that more than 80% of what Uber earns is automatically transferred to drivers, Gross Bookings is a figure that vastly overstates what the platform really sees. A parallel would be a price-comparison website focusing on the ‘premiums sold’ or ‘$value of loans processed’ via its platform as its top-line figure. And yet, we see graphs like this high-lighting Uber’s ‘gross bookings’ figure everywhere:

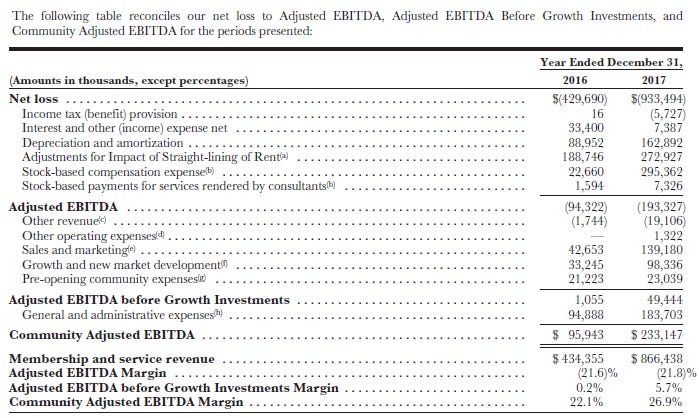

Uber and Ebay are hardly exceptions. The most interesting one in recent memory is WeWork and its use of ‘Community-adjusted EBITDA’. Here’s how that worked:

For those not inclined to dig deep, WeWork is trying to argue that expenses like ‘sales & marketing’ and ‘community expenses’ (i.e. free beer at all the WeWork locations) are one-off expenses and won’t be really needed in the future. Thus, a company $190M in the red ended up with a healthy $230M profit in 2017. WeWork’s creative accounting tactics were mocked by many in Wall Street but given that the company is worth c.$50B today, they’ll trade a few laughs for a lofty valuation.

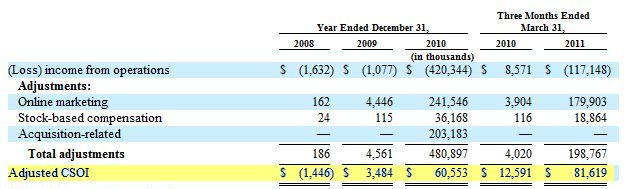

Lastly, take Groupon - a Wall Street darling at its IPO only a few years ago that has since seen its value decline from $30B to $2B. In its IPO S-1, the company made a big deal of focusing on “Adjusted CSOI” or adjusted consolidated segment operating income. Here’s how that was calculated:

The eagle-eyed amongst you might have noticed that a $420M loss transforms into a $60M profit in 2010.

I’m sure many more examples of this phenomenon abound. Recently at NOAH Berlin, all the scooter companies made a big deal about the ‘# of days to 1Million rides’ as if that has any actual value to the company’s underlying performance. Moreover, given that most initial rides for users are either free or heavily subsidized, that makes this number even more meaningless.

The new age of ‘AI’ companies is bringing us all kinds of crazy metrics which companies are using to raise money. Mega-funds like SoftBank are all too happy to absorb such metrics given that they are spewing similar stuff in their own presentations. Here’s a couple of recent SoftBank slides in their investor update:

Beyond talks of a ‘tech’ bubble, it is important to realize that ultimately perception feeds reality. While cash is king in the long-run, in the short-run companies can feed off beliefs and momentum. If investors believe that Tesla is worth $100B, that ‘paper’ valuation allows it to borrow against that market cap at favorable rates. Using that debt, the company can then hire a tonne of brilliant engineers and actually build a better product. While public markets ultimately always catch on, there is generally a period of valuation disconnect for new ideas/projects.

Large enterprises generally lose out here as they are valued at a blended multiple that is almost entirely based on the legacy business. However, if enterprises separate out their new ventures appropriately (ala Alphabet and Amazon), the market will catch on sooner and give companies leeway sooner. If you’re a capex-heavy business that has a new SaaS product taking off, it likely makes sense for you to provide financials around the SaaS business early on. Most public companies worry about providing financial details in early years out of fear of competitive response. In reality, it might favor incumbents to immediately disclose details around new projects after they hit certain revenue milestones so that analysts can update their valuations accordingly. And whether they employ ‘alternative-reporting’ measures for their new AI/blockchain-enabled businesses is their own prerogative :)